Is the stock market Halal? List Halal stocks. Are mortgages allowed in Islam? Can I make money from interest?

Let’s face it – we love money!

Some of us will even overlook Islamic guidelines to increase the bank balance. However, Allah has a better return.

Building wealth while keeping the income Halal can be a struggle for Muslims around the globe.

But, it’s worth it.

There are plenty of options for making money in Islam. Such as, investing in Halal stocks and shares, getting a side job or even earning through an online blog.

You don’t need a head start with a Engineering degree or wealthy parents, it’s totally possible to build up a substantial amount of Halal money from any level. Take me as an example.

About me

I was born in the UK, studied Business & Psychology at University and landed a 9 to 5 in an online marketing role.

My parents constantly told me to buy a house, as the value of cash goes down with time – and they’re right.

However, there was one problem. They wanted me to get a conventional mortgage, and this was not a route I was prepared to take for religious reasons.

Buying a house without a mortgage has been a strong ambition of mine, and I am pleased to say I am making great progress. So how did I, a marketing employee with a ‘micky-mouse’ degree, get to such a strong position?

This article will explore the steps I have taken, with a focus on Halal stocks and shares, as well as other routes to building wealth in Islam.

How to Make Money in Islam

In this post we will explore:

- Islam & Money

- Is Interest Halal or Haram?

- Halal Stocks and Shares

- Buying Property with an Islamic Mortgage

- Working

- Freelancing

- Earning through a blog

- Earning by saving

- Giving to Charity

- Getting Married

Islam and Money

In short, it’s ok to make money in Islam… as long as it doesn’t become the ultimate goal. Rather, we should focus on getting closer to Allah.

Because Allah has more to offer:

Beautified for people is the love of that which they desire – of women and sons, heaped-up sums of gold and silver, fine branded horses, and cattle and tilled land. That is the enjoyment of worldly life, but Allah has with Him the best return

(Quran 3:14)

But seeking wealth is permitted:

We have made the night and the day two wonders. We erased the wonder of the night, and made the wonder of the day revealing, that you may seek bounty from your Lord, and know the number of years, and the calculation, We have explained all things in detail.

(Quran 17:12)

Intentions, intentions, intentions

It’s important to remember our reasons for building wealth in the first place.

New house? New car? Designer clothes?

All allowed. However, the best reasons are the Islamic ones. Such as accumulating wealth to avoid something haram (say a mortgage), or to provide for the family.

“Actions are according to intentions, and everyone will get what was intended…

Bukhari & Muslim

Above all, have a plan. Don’t hoard wealth:

“O you who have believed, indeed many of the scholars and the monks devour the wealth of people unjustly and avert [them] from the way of Allah . And those who hoard gold and silver and spend it not in the way of Allah – give them tidings of a painful punishment.” (Quran 9:34).

(Quran 9:34)

Is Interest Halal or Haram?

Interest is a common way to build wealth in today’s world, everyone does it.

But, is this allowed in Islam?

No.

In his book Al-Kabair (The Major Sins), Muhammad bin ‘Uthman Adh-Dhahabi ranked interest as the 12th major sin. Worse than consuming the property of an orphan, gambling, stealing or spreading lies about Allah.

So, avoid.

Quran on Interest

The word ‘Riba’ translates to ‘Usury’ or ‘Interest’, and is mentioned in 12 verses of the Quran. Let’s take a look at some of them.

Clearly forbidden

Allah clearly forbids interest:

Believers! Do not swallow interest, doubled and redoubled, and be mindful of Allah so that you may attain true success

(Quran 3:130)

Allah declares war on those who consume interest

And it’s the only sin he declares war on.

Believers! Have fear of Allah and give up all outstanding interest if you do truly believe. But if you fail to do so, then be warned of war from Allah and His Messenger. If you repent even now, you have the right of the return of your capital; neither will you do wrong nor will you be wronged.

(Quran 2:278-279)

Isn’t interest similar to trade?

No. Allah clarifies this himself in Surah Baqara:

But those who take usury will rise up on the Day of Resurrection like someone tormented by Satan’s touch. That is because they say, ‘Trade and usury are the same,’ but God has allowed trade and forbidden usury. Whoever, on receiving God’s warning, stops taking usury may keep his past gains- God will be his judge- but whoever goes back to usury will be an inhabitant of the Fire, there to remain.

(Quran 2:275)

Hadiths related to interest

The prophet Muhammed (PBUH) spoke on this topic in his farewell sermon.

…God has decreed that there will be no usury, and the usury of ‘Abbās b. ‘Abd al-Muṭṭalib is abolished, all of it…

(Muslim, Book 15, Hadith 159)

Most importantly, he said that interest is like a curse.

In this powerful Hadith, not only is the receiver of interest cursed but also the one paying it, the one recording it and any witnesses.

From Jabir : The Prophet said, may be cursed the receiver and the payer of interest, the one who records it and the two witnesses to the transaction and said: “They are all alike [in guilt].”

(Muslim)

But why is interest so bad?

The main reason we stay away from Interest is simple, because Allah told us to.

But let’s try to understand why that might be the case.

Interest is Unjust

…neither should you commit injustice nor should you be subjected to it

(Quran 2:279)

In short, Interest causes the rich to get richer and the poor to get poorer. On a macro scale this results in super rich countries, and super poor ones. In 1960, 20% of people in the richest countries had 30 times the income of the poorest 20%, and in 1997 it was 74 times as much (1). So, by taking interest we are contributing to an un-balance of wealth in society.

Money for nothing

Getting paid in interest provides you with money for nothing. But, we are encouraged to work hard in Islam.

“By him in whose hand is my soul, if one of you were to carry a bundle of firewood on his back and sell it, that would be better for him than begging a man who may or may not give him anything.”

Bukhari 1401

Interest in the Bible

Islam is not the only religion to ban Interest.

If thou lend money to any of My people, even to the poor with thee, thou shalt not be to him as a creditor; neither shall ye lay upon him interest.

(Exodus 22:24)

Did you know Interest was banned in the England? This came with the rise of Christianity, eventually made legal by Henry VIII in 1545.

Make money through other means

Interest is a no no, but then how do we make money?

One approach is to invest in stocks and shares. The return can be much higher than the return from interest.

However there is risk involved. It’s possible to loose some or even all of your money. On the plus side, that makes it Halal!

Halal Stocks & Shares

Perhaps the quickest way to grow your wealth, but also the most risky.

Stock markets are where individual and institutional investors come together to buy and sell shares in a public venue. Nowadays these exchanges take place online or through an app. Share prices are set by supply and demand, as buyers and sellers place orders.

The terms ‘stocks’ and ‘shares’ are often used interchangeably, with ‘stocks’ being the popular phrase in the US and ‘shares’ in the UK. However, there are some differences between the terms.

How does the stock market work?

If you’re new to investing I strongly recommend watching the Netflix Explained video below.

How to make money with Halal stocks & shares

When you purchase a stock, you are essentially buying a piece of a company and therefore become a part-owner of that firm.

In practice, the company would take your money, use it to grow their business and generate more profit.

But how do you make money?

There are two ways:

What are Dividends?

A dividend is a distribution of profits by a corporation to its shareholders. The payment frequency varies, however it’s usually paid on a quarterly basis.

Example:

Let’s say I bought 200 Shares of company A for £1,000, and it pays a dividend of 5p per share. I receive £10 each quarter.

I may choose to re-invest that £10 back into the company to earn a higher dividend next time. If the company does well, it might increase its dividend in the future.

You will be surprised how quickly wealth can accumulate over time, especially if you’re reinvesting your dividends. The image below shows the fantastic effects of compounding on a portfolio with a 3% dividend yield and a 7% dividend growth rate.

Profit from selling shares

Not all companies pay a dividend. So why would you invest in them?

Two reasons:

- Because you think the stock price will go up in the future, and aim to sell for a profit at a later date.

- Because you think the company will pay a dividend in the future, so you buy while the stocks are cheap and hold until then.

Stock prices have the potential to go up as well as down. But, it’s not uncommon for the price to double or triple over the space of a year. Especially, in the current climate.

Examples of stock price changes

Let’s take a look at some examples in the real world. These are for illustrative purposes only and not a recommendation.

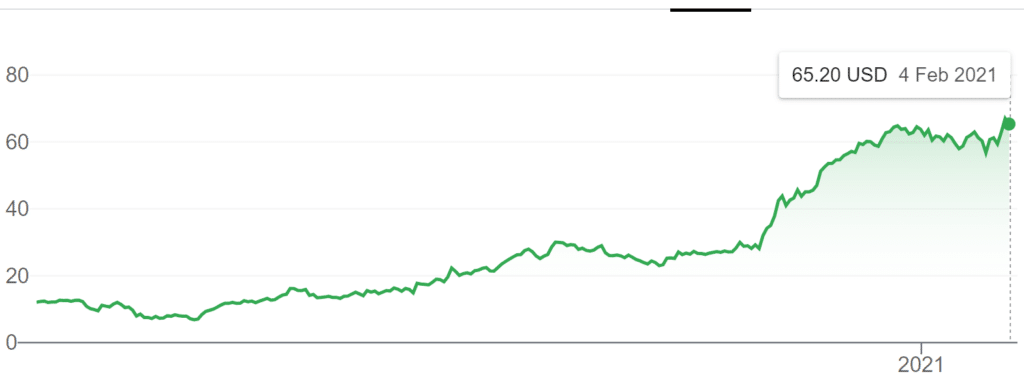

Farfetch

The company has been booming since Lockdown, as more people turn to online shopping. Over the past year the stock price has gone from $6 to $65 – a huge gain.

Tesla

The returns on Tesla have been quite amazing, growing X3 within the space of a year, and over 4,000% since their IPO.

Adobe

Photoshop, Adobe Sign and Premier Pro are just some of Adobe’s products. The Adobe stock price has shown steady growth over the past 5 years.

But are stocks and shares Halal?

There is nothing wrong with the concept of investing. In fact, investing is encouraged.

On the other hand, many companies have a high level of debt or make money from impermissible activity – investing in these firms is not Halal.

Therefore, it’s vital to do your research before picking which stocks to invest in.

How to screen for Halal stocks and shares

Before picking a stock, it’s important to look through the company financial statements in order to see whether the business is Sharia compliant.

But, what do you look for?

Islamic Finance Guru is a website that provides information about Halal investing in the UK. The team have written a guide titled ‘How to buy Halal Stocks – Stock Screening Method‘, a must read for anyone new to Halal investing.

Let’s summarise their five stock screening criteria below.

1. Is the business halal?

This one is easy. Does the business make money by selling non-Islamic items such as Alcohol or Pork? If so, we cannot invest.

2. Do they have other non-halal income?

Let’s assume the business is Halal, we can invest right?

Wrong.

We need to look further to ensure there is no income generated from non-Islamic sources, such as interest. The company income statement will show this, available on Yahoo Finance.

Scholars have put forward a 5% rule. That is to say, no more than 5% of the revenue should come from unislamic sources, and you must give away that portion in charity.

3. What’s their Debt-to-asset ratio?

In order for a stock to be Halal, the debt-to-asset ratio must be below 33% (some screening methods will consider debt-to-equity).

Why 33%?

It’s based on the following hadith:

Narrated / Authority Of: Amir bin Sad that his father said: “I became sick during the year of the Conquest, and was at death’s door. The Messenger of Allah (saw) came to visit me and I said: ‘O Messenger of Allah (saw), I have a great deal of wealth and no one will inherit from me apart from my daughter. Can I give two thirds of my wealth in charity?’ He said: ‘No.’ I said: ‘Then half?’ He said: ‘No.’ I said: ‘One third?’ The Prophet said: One third and one third is a lot. If you leave your heirs rich that is better than leaving them destitute and begging from people.” Sahih

Ibn Majah. Hadith 2708.

The Hadith is not speaking about debt, however ‘one third is a lot’ has been derived as the allowable amount of debt by scholars. Of course, if we can avoid companies with debt that would be best.

4. Illiquid assets to total assets ratio

This is related to assets that cannot be converted to cash quickly. Learn more in the original post by Islamic Finance Guru.

5. Net liquid assets v market capitalisation

This criteria is a little more complex and rarely relevant. Net liquid assets should not exceed the market capitalisation. Read the original post by Islamic Finance Guru to learn more.

Halal Stock Screener Apps

It’s best to review the financial statements for every stock you buy.

But what if finance isn’t your thing?

Don’t worry.

There are several apps that can help you screen stocks and shares from a shariah perspective. Far easier than looking through the financial statements.

Zoya

The Zoya app allows users to check whether a specific stock is shariah compliant or not.

And, it’s free.

Let’s take a look at some examples.

Rio Tinto

A metal mining firm, they make money from finding and processing metal such as Iron Ore and Copper – nothing wrong with the nature of the business. But are they Sharia compliant?

Yes.

As of Feb 4th 2021, Rio Tinto is considered Sharia compliant by the Zoya app. If we scroll further we can see whether the company pays a dividend and if so, how much. In this case it does, and it’s pretty good.

Premium users can view the full breakdown as to why the stock passed or failed.

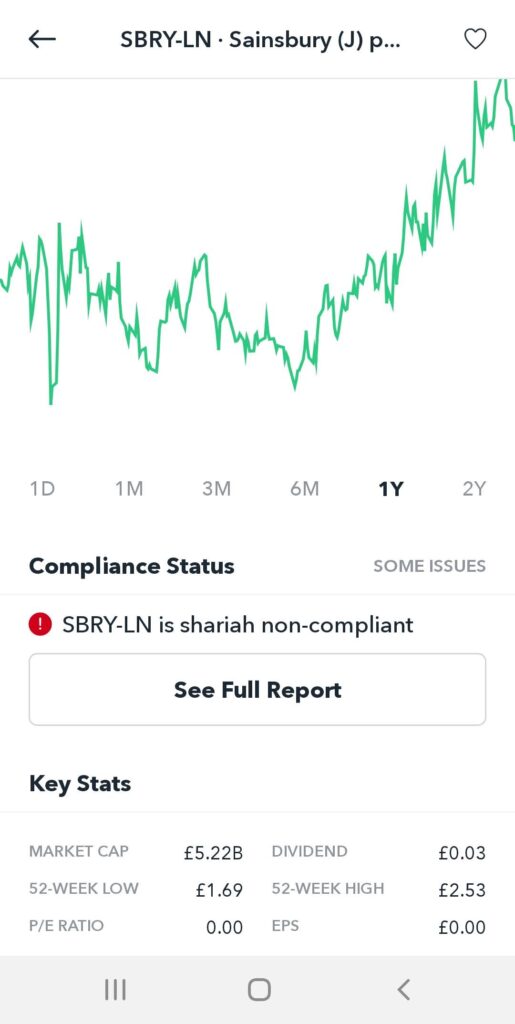

Sainsbury

A well-known supermarket selling food and drink. But does it pass?

No.

We can see that the stock price has increased over the past 6 months, however Sainsbury is not Shariah compliant according to the Zoya app. This may be due to high revenue from non-Islamic sources such as interest, alcohol and non-halal meat.

Islamicly

Another great screener app.

Previously the free version allowed users to check a stocks compliance, but this is no longer offered unless you are a premium user. Therefore, I would recommend Zoya for beginners.

Interest-free companies

There are a small number of companies listed on the stock exchange that are totally debt free, or interest free.

At the time of writing, two examples come to mind: Intuitive Surgical (ISRG) and Monster Beverage Corporation (MNST).

However, there are not many.

Luckily, our friends at Islamic Finance Guru have put together a list of zero-interest companies. Some of the information may no longer be valid, but it’s a great place to start.

Start with a Fund or ETF

Funds offer an easy and convenient way to invest, and are popular with both novice and experienced investors.

A fund pools together the money of lots of different investors, and a fund manager invests on their behalf. Funds can invest in various types of asset, such as shares, bonds or property, depending on the investment objective of the fund.

In our case, we will be looking for Shariah compliant funds. Here are some examples:

Halal Funds

Wahed Invest

HSBC ISLAMIC GLOBAL EQUITY INDEX

We may also decide to invest in an Exchange Traded Fund (ETF); a fund that can be traded on the stock exchange just like regular shares.

Halal ETFs

iShares MSCI:

World Islamic UCITS ETF

USA Islamic UCITS ETF

EM Islamic UCITS ETF

How to start investing

To start investing you will need to sign up to an investment platform, such as Hargreaves Lansdown (HL) or AJ Bell.

From there you can add funds to your account and start purchasing shares.

But, keep it Halal at every level.

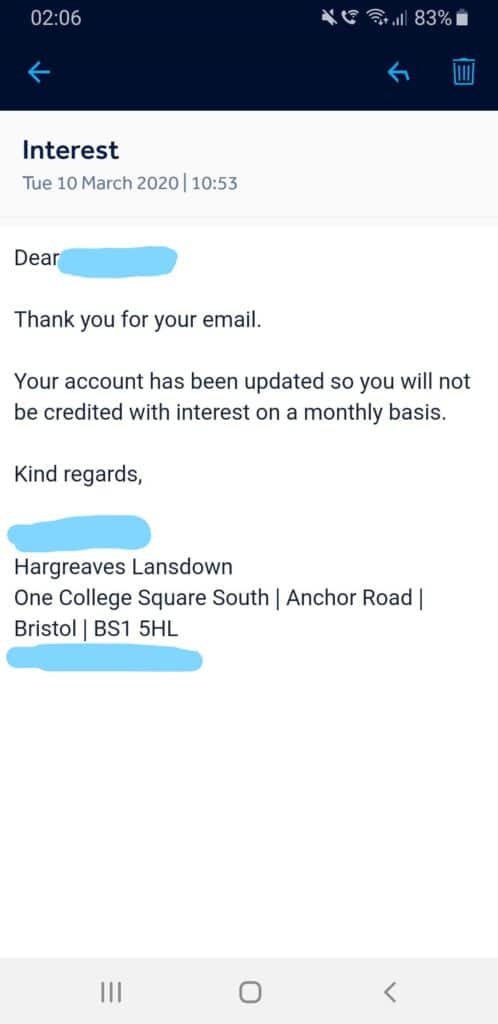

Some investment platforms pay interest on the money held in your account. For example, AJ Bell pays interest once you have more than £10,000 in your account. Therefore, its important to contact the service and ask for the interest to be removed.

I personally use HL and they were more than happy to switch off the interest on my account. Just send them a secure message through the app.

Day trading vs Investing for the long-term

Day trading is when you buy and sell shares on the same day.

There are differences of opinion about whether day trading is allowed in Islam, but we find more arguments against day trading in Islam than for it.

The problem with day trading is that it usually takes a couple days for your shares to be processed, and therefore you will be selling things you do not own.

…He said: “Do not sell that which you do not possess.”

At-Tirmidhi, 1232; an-Nasaa’i, 4613; Abu Dawood, 3503, Ibn Maajah, 2187, Ahmad, 14887.

In addition, many argue day trading is similar to gambling. The company doesn’t have enough time to benefit from your money and therefore it’s not quite investing.

Zakir Naik gives his view below:

So, invest for the long term.

Stocks and Shares Tiktokers

If you’re on Tiktok I would recommend two accounts:

Nadertohamy17

Aka the Halal Investor.

Nader focuses on analysing stocks in terms of Sharia compliance, and he’s funny!

He gives excellent advice at the end of most of his videos: “Always do your research and Allah knows best”, and is more than happy to answer Halal investing questions.

Here is a short video from Nader explaining how to pay Zakat on stocks:

@nadertohamy17 Reply to @hussein.ahmed185 Zakat #charity #halalinvest #zakat #stocks #investing #muslim #halal #islam #muslimtiktok #foryou #fyp

♬ original sound – Nader The Halal Investor

Not only does she have a great name, but Lama Mama has given a great overview of Halal stock investing recently and many are benefiting from it.

Lama explaining Dividend investing for beginners:

@lama_mama_ Reply to @s.bexy hope this helped❤️#lamamama

♬ original sound – Lama🌸

With all Tiktockers, remember to do your own research before jumping into a trade – run any company names through Zoya to ensure it’s compliant, or check the financial statements.

Another great Tiktok account to follow. Kenneth gives fantastic advice.

This creator is not Muslim, in fact he is Jewish, however the advice he provides is pretty much in-line with Islamic values.

Kenneth never recommends a stock rather he teaches how to find stocks, value the company and places strong emphasis on having a plan.

@tradeinvestsimplify Reply to @bobbybeaux #amc #gme #investingforbeginners #investingtips #stocktok #gamestop #tradingtips #genz #daytrader #robinhoodstocks #money #fyp

♬ original sound – Kenneth Suna

Stocks and shares not for you?

Worry not.

There are other approaches you can take to building wealth. Such as buying property.

Invest in Property With an Islamic Mortgage

Investing in property is a great way to build wealth, either by charging rent or saving on it. However, you need capital – lots of it.

We have already discussed the prohibition of Interest in Islam, which includes getting a mortgage. But, Halal Mortgage alternatives are available.

How do Halal mortgages work?

There are three main types:

1. Ijara

This is when the bank purchases the property you want to buy and leases it to you for a fixed term, at an agreed monthly cost. When the term is over, full ownership of the property will be transferred to you.

2. Musharaka

This is a co-ownership agreement, where you and the bank own a separate share of the property. Each time you make a repayment, which is part capital and part rent, you buy more of the bank’s share. Your rent reduces as your share grows and, eventually, you’ll own the bank’s share of the property.

3. Murabaha

This is when the bank buys the property on your behalf. They then sell the property to you at a higher price. The higher price is repaid by you in equal instalments over a fixed term. For example, you may be looking to buy a house valued at £150,000, but the bank may sell the property to you for £200,000.

Halal mortgages are debated

The concept of a Halal mortgage is debated among scholars. Many Muslims argue that interest is still payed without calling it Interest, or the intentions are not pure. For example, the bank will usually get you to sign a separate contract that eliminates risk on their side. A few minutes or seconds pass between the signing of these contracts to ensure there is some element of risk involved – even if only a few seconds.

What other ways can we make money in Islam?

Work, Work, Work

It might sound obvious, but having a stable 9 to 5 job provides a steady flow of income.

After that, the money can be used to increase your wealth further investing in Halal stocks and shares, or into a side project.

Struggle with interviews?

Make a list of all the jobs that you have applied for and keep going, the more you apply the greater your chances. When I first graduated in 2010 I went through 65 applications before landing my first role four months later.

Nowadays, there are a great deal of free training videos on any subject of your choice. You can learn how to code online, or become a master in Excel – skills which can help with job applications.

Become a Freelancer

Freelancing as a second job can help generate income from multiple sources.

Perhaps you enjoy photography, driving or have great skills in graphic design – why not make money from it?

Here are some examples of freelancer projects and side jobs for inspiration:

- Ride-share driver

- Food delivery driver

- Online writer

- Graphic designer

- Virtual assistant

- Sell items online

- Deliver groceries

- Online tutoring

- Photography / Videography

Once you’ve established a side project it’s time to begin.

But, how do you get started? Here are three steps:

1. Set up your business

Regardless of your choice you will need to get yourself set up. In the UK, you have two main options:

Becoming a sole trader is great for small jobs. Just remember from a legal perspective you and the company are one.

So, if someone takes you to court you may have to pay from your own pocket. If you refuse to pay, then bailiffs have the right to remove personal possessions from yourself even if they are unrelated to the business (because you are the business).

Another option is to set up a limited company which acts as a separate entity. Although, there is usually more accounting work.

Rules vary in other countries around the world, so please do your research before getting started.

2. Promote yourself

You’ve set up as a Sole Trader or Ltd company, great! What next?

Get the word out there.

Social media offers a great opportunity to promote yourself online. Set yourself up on Facebook, Instagram, Twitter, Pinterest and TikTok.

You don’t even need a website these days. Chances are your customers will enquire through one of the social media sites listed above.

Instead, try using a link page such as linktree or Beacons.

What are these?

It’s a webpage that contains all the links to your social media. At Islamic Music Hub we use Beacons, check it out (the latest post wobbles!).

Those who wish to build a website can do so using Wix, a powerful website builder that requires no coding skills.

Advertise on a Freelancer site

Freelancer websites are a great place to promote your side-hustle.

How do they work?

Simply upload a profile to the website along with some examples of your work. You can usually choose to charge a set hourly or daily rate, and are given the option to negotiate before signing a deal.

Examples of freelancer websites:

3. Build up

You have your first customer – great! The next step is to build on the business.

Go above and beyond in order to provide a great service and ask for feedback, both personal and on feedback sites such as Trustpilot. Positive reviews will help others find and trust your busines, leading to more sales.

Once you have a customer base, you can increase your services. For example, by adding another employee or buying new equipment, allowing you to charge more.

Earn Through a Blog

There are three main ways to make money from an online blog. In fact, a couple of these methods are used here at Islamic Music Hub.

Place Google Ads on your website

Google allows users to place ads on their own website or blog, and pays you each time one of your visitors clicks an ad.

How to get started?

Create an Adsense account – the first step is to sign up to Adsense. This is the Google platform that allows you to manage your ads.

Get your code – Before ads can show up, you will need to place a code onto your website. The code is provided once you add a site into Google Adsense.

Create an Ad – You may decide to create individual ad units and place them in selected locations on your site. Or, allow Google to place the ads for you.

When to add ads

Placing ads onto your website can slow it down, and annoy users.

Be wise.

You should allow your blog to build up before placing ads onto it. I’d say wait until you have at least 100 organic visitors per day.

How much can you get paid?

The answer to this question varies depending on the amount of traffic you get, and where you place your ads.

You might receive 1p per click or £1.50 – it all depends on how much the advertiser is bidding.

Tip: Don’t just rely on Google. Feel free to sell advertising space on your website directly – you might get a good deal.

Earn money through Affiliate Marketing

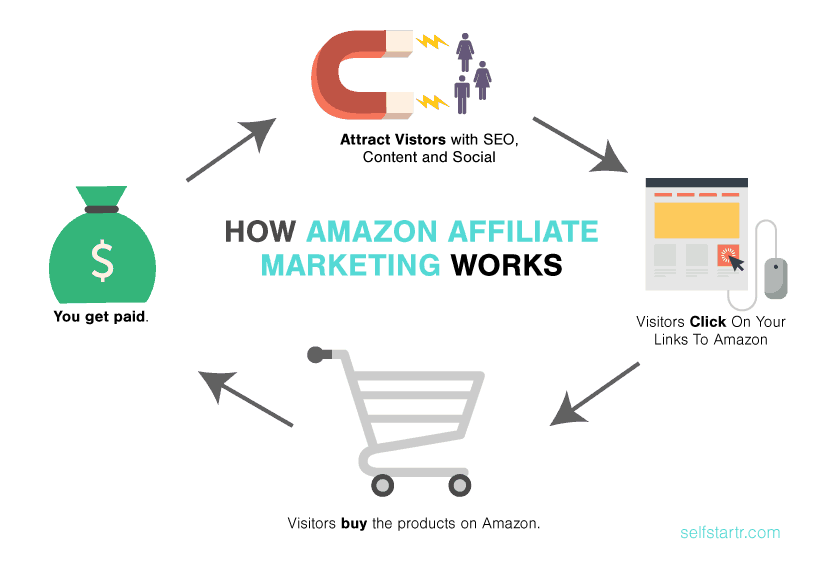

The concept of Affiliate Marketing is simple:

- You provide a link to another website through your blog or social media

- A user clicks on your link and makes a purchase on that site

- You earn a small commission

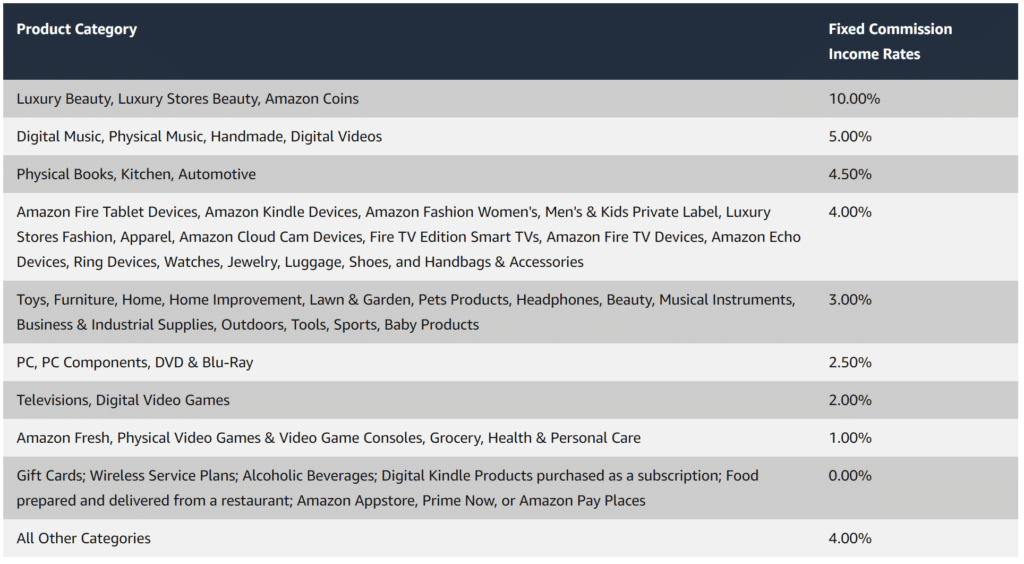

Amazon is one of most popular affiliate programs. You can sign up through Amazon Associates and generate links to products related to your blog.

Take a look at this investor book as an example of an affiliate link. Users who click are directed to the relevant page on Amazon.

Furthermore, users do not need to buy the advertised product in order for you to generate money.

What do I mean?

Once a user clicks on the affiliate link, Amazon starts a 24 hour countdown. If the user buys anything on Amazon in that time, a percentage of the earnings will be given to you.

Imagine a user clicking on a link to a book but buying an expensive Smart TV instead. You’ll get a percentage!

How much can you make?

See below.

Sell products on your site

The final way involves making money through selling merchandise.

Custom T-Shirts, Caps, Hoodies are great examples. Of course, it depends on the nature of your blog.

Use Shopify to create an ecommerce website and start selling.

A Penny Saved is a Penny Earned

When thinking about building wealth, we often think about being promoted or moving to a higher paid role.

Higher salary = higher tax.

So, a far more effective way to build wealth is not by earning more, but by spending less. Because, little things add up.

In fact, you’ll be surprised just how much wealth you can save by replacing that morning coffee with the free version at work, especially when calculated over a long period (try 10 years).

But, Islam says spend.

O ye who believe ! spend out of what we have bestowed on you before the day comes wherein there shall be no buying and selling, nor friendship, nor intercession, and it is those who disbelieve that do wrong to themselves.

(Quran 2:255)

It’s true. Islam teaches us to spend rather than hoard. However, if you are saving for something specific then there is nothing wrong with this approach. Remember, it’s all about intentions.

Try cutting out questionable items such as your Netflix subscription, Spotify or buy an older next phone.

Giving to Charity Will Increase Your Wealth

It sounds odd. Giving money away to increase it.

But, bear with me on this one.

Allah says he will return and multiply the reward for those who give in charity. It takes some faith but those who give to charity will see their wealth return in some shape or form.

“There is not a single day in which a servant wakes that two angels come down (from the Heavens). One of them says, O’ Allah! Give to the one that spends a substitute (for what he has spent). And the other one says, ‘O Allah! Give to the one that withholds (his money) destruction!”

(Al-Bukhari and Muslim)

Get Married

You might ‘lol’ at this one. But it helps.

Having a spouse can increase your chances of getting rich quicker, especially if they are working full-time.

What if your spouse does not work?

No problem. Perhaps they can start an online blog, help you with a side project or monitor investments closely.

Of course, we should try to pick a spouse based on their religious commitment over wealth, which was the guidance of our prophet.

“A woman may be married for four things: her wealth, her lineage, her beauty and her religious commitment. Seek the one who is religiously-committed, may your hands be rubbed with dust (i.e., may you prosper).”

Bukhaari (4802) and Muslim (1466)

Also bear in mind that in Islam a husband is required to provide for himself and his wife, whereas the wife can do what she likes with her money.

Did you know? Men get twice as much inheritance in Islamic wills due to the reason above, and not because Islam is unjust to women as some people claim.

No luck finding a spouse? See my post about how to find a spouse during lockdown.

Summary

There are plenty of Halal choices when it comes to making money in Islam.

While some conventional methods (such as interest) are not be allowed, we have the option to invest in shares, work, rent out property bought with an Islamic mortgage, or make money through more innovative ways.

But, remember to keep your intentions pure.

Money is nothing, and we can’t take it with us when we leave from this world.

Have more suggestions about how to make Halal money? Let us know in the comments section below.

I’d like to end by sharing one of my favourite Nasheeds by Zain Bhikha titled ‘Can’t take it with you’ – after all, Nasheeds are what Islamic Music Hub is all about.

Leave a comment below.

![HALAL INVESTMENT IN STOCKS, INDEXFUNDS, ETFs & SUKUK: INVEST IN COMPLIANCE WITH ISLAMIC LAW by [Fadel Jannuse] islamicmusichub](https://m.media-amazon.com/images/I/51BhFazrbwL.jpg)

![Muslim Investor: The Stock Market Made Simple by [Farhan Khalid] halal stocks](https://m.media-amazon.com/images/I/410ItrhfvZL.jpg)

I wish there were more Halal ETFs